axio

Expense Tracker & Budget

Description of axio: Expense Tracker & Budget

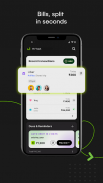

axio App is an SMS-based money management app that makes managing money and tracking expenses simpler than ever. With our personal finance management app’s expense tracker feature, you can effortlessly track daily and monthly expenses, plan your budget, stay on top of all your bills, and receive timely payment reminders. Plus, axio now supports booking Fixed Deposits without requiring a bank account. Invest in fixed deposits online in under 3 minutes with a completely paperless process backed by the security of on device SMS based verification

With axio Money Manager - your personal money management app, the best expense tracker and a handy personal finance app, you don't need to manually enter your expenses. Tracking expenses automatically, it monitors your financial activities and provides a clear breakdown of your expenses and bill reminders.

Money Manager’s top features include:

✨Keep a close track of your personal monthly and daily expenses including your credit card dues

✨See all daily expenses at a glance - from Bank Accounts, Credit Cards, Digital Wallets, Sodexo, etc.

✨Check bank balances

✨Check all your utility bills such as electricity, DTH, Gas, Mobile, & Wi-Fi

✨Add notes, custom categories, tags, & bill/receipt photos to transactions

✨Easily search for expenses, tags, or notes

With the axio app you gain exclusive access to:

axio Pay Later

With our carefully designed Checkout Finance feature, you can enjoy the convenience of flexible EMIs ranging from 3 to 36 months*.

>Hassle-free credit

>Available at over 4000+ online merchants

>No-cost EMIs*

axio Personal Loan

Eligible users can apply and avail Personal Loan from the axio App.

axio Fixed Deposit

Give your savings a boost by investing in a Fixed Deposit on the axio App

>Higher Interest Rate

>RBI Regulated and DICGC Insured

>Flexible Tenures and Zero premature Withdrawal

▶ EMIs

*Interest rates for axio loans start from as low as 14% & go up to 35% per annum for a tenure ranging 06 to 36 months. A processing fee of upto 2%(+GST) is also applicable on each disbursal.

A representative example: If you take a loan of Rs. 1 Lakh (Principal) at an annual interest rate of 15% (APR) for a tenure of 24 months - your EMI will be around Rs. 4,849 & the processing fee would be Rs. 2,000(+360). Total cost of the Loan would be Rs.1,18,728

▶ About axio

Credit offered by Axio Digital Pvt. Ltd. (formerly known as Thumbworks Technologies Pvt. Ltd.) on the axio app is facilitated by RBI-registered NBFC CapFloat Financial Services Private Limited.

Axio Digital Pvt. Ltd. does not involve itself directly in any money lending activities and only facilitates money lending by providing a digital platform to registered Non-Banking Financial Companies (NBFCs) or banks or via co-lending arrangements. https://axio.co.in/corporate-information/

axio (formerly known as Capital Float, Walnut & Walnut 369) is the brand name of CapFloat Financial Services Private Limited, an NBFC registered with the RBI.

CapFloat Financial Services Private Limited is one of the founding members of the Digital Lenders Association of India (DLAI), an organization dedicated to promoting fair lending practices within the country. You can access DLAI's Code of Conduct by visiting the following link: https://www.dlai.in/dlai-code-of-conduct/

axio App provides SMS-based money management, and access to financial products like Checkout Finance, Personal Loans, and Fixed Deposits.. It does not read your personal SMSs or upload any sensitive data.

SMS Permission is used in the following features:

- Personal Loan: Fraud prevention and security

- Money Manager: Analysing transactional SMS messages, detecting spends, managing bills, and budgeting

- Fixed Deposit: SMS-based SIM-device binding to safeguard your investment journey

For more info, please write to us at ask@axio.co.in or refer to https://axio.co.in/about-us/